Table of Content

Welcome to a comprehensive guide on understanding the basics of the accounts receivable process. In this article, we'll explore various aspects of accounts receivable, discuss ways to streamline the process, delve into handling special situations, and highlight the key differences between accounts receivable and accounts payable. So sit tight, grab a cup of coffee, and let's dive in!

Understanding the Basics of Accounts Receivable

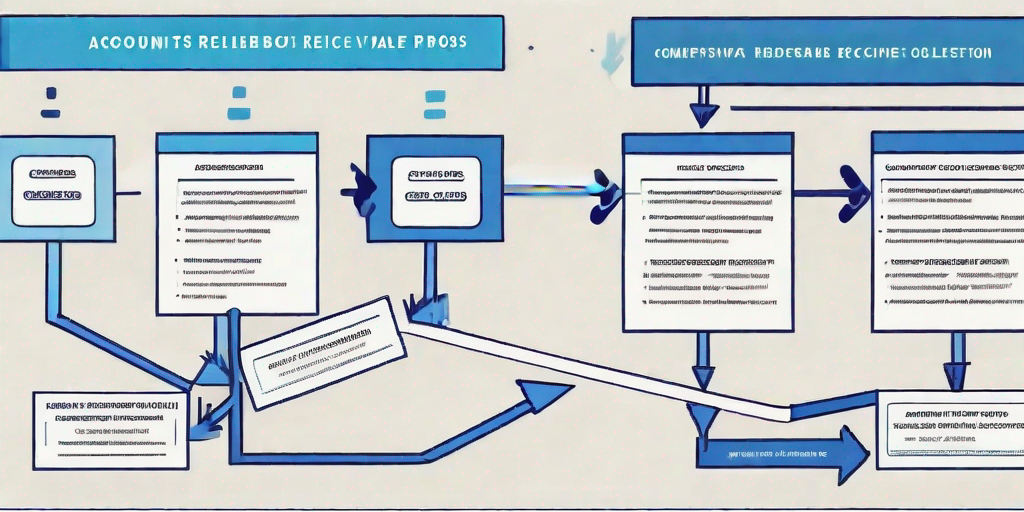

In order to grasp the intricacies of accounts receivable, it's essential to familiarize yourself with the accounts receivable cycle. This cycle encompasses every stage of the process, from generating invoices to collecting payments. It's like a well-choreographed dance, except without the fancy costumes.

Let's dive deeper into the fascinating world of accounts receivable and explore the various steps involved in the cycle. Picture this: you provide goods or services to your customers, and in return, they promise to pay you at a later date. This promise is transformed into an invoice, which is then sent to the customer. The invoice serves as a formal reminder of the debt owed to you.

Once the customer receives the invoice, they are obliged to pay you within a specific timeframe. This timeframe is usually agreed upon beforehand, ensuring that both parties are aware of their responsibilities. It's a delicate balance between trust and financial accountability.

Now, here's the fun part: if the customer pays you on time, you can sit back, relax, and rejoice in your financial triumph. The payment received adds to your cash flow, allowing you to meet your own financial obligations and invest in the growth of your business. It's a satisfying feeling, knowing that your hard work is being rewarded.

However, if the payment is delayed or, heaven forbid, not made at all, a series of collection efforts ensue. From friendly reminders to more assertive phone calls, the goal is to collect what is rightfully yours. These collection efforts require tact and diplomacy, as maintaining a good relationship with your customers is crucial for future business opportunities.

Who Benefits from Accounts Receivable?

Accounts receivable aren't just beneficial for business owners. They are an essential part of the economic ecosystem, providing cash flow to companies and allowing customers the flexibility to pay over time. This flexibility can be particularly helpful for individuals or businesses facing temporary financial constraints.

Imagine a small business owner who needs to purchase new equipment to expand their operations. Instead of paying the full amount upfront, they can negotiate an installment plan with the equipment supplier. This arrangement allows them to manage their cash flow more effectively and invest in their business without depleting their reserves.

On the other hand, accounts receivable also benefit the customer. They provide an opportunity to acquire goods or services immediately, even if they don't have the full amount available at the time of purchase. This flexibility allows individuals and businesses to meet their immediate needs while spreading out the financial burden over a specified period.

So, the next time you find yourself signing on the dotted line for an installment plan, remember that accounts receivable are the backbone of that transaction. It's a relationship built on trust, with money exchanging hands like a game of financial tag. Both parties rely on each other to fulfill their obligations and maintain a healthy financial ecosystem.

Streamlining Your Accounts Receivable Process in 5 Steps

Now that we have a solid understanding of the basics, let's explore ways to streamline your accounts receivable process. Remember, efficiency is key – like the grease that lubricates the wheels of a well-oiled machine.

Establishing Effective Credit Application Policies

First things first: you need to ensure that you're extending credit to customers who are trustworthy and financially capable of paying you back. Establishing effective credit application policies allows you to evaluate potential customers and determine whether the risk is worth the reward.

So, buckle up and start conducting credit checks, evaluating credit scores, and asking for references. It's like playing detective, but with financial stability on the line.

Simplifying Invoicing and Documentation for Customers

No one likes complex invoices and tangled documentation. It's like trying to decipher the Da Vinci Code, but without the enchanting historical context.

By simplifying your invoices and documentation, you're not only making life easier for your customers but also increasing the chances of prompt payment. So, keep it simple, straightforward, and easy to understand – just like an IKEA instruction manual.

Setting Clear Deadlines for Payment

Ah, deadlines – the necessary evil of the business world. But fear not, for they serve a purpose beyond striking fear into procrastinators. By setting clear deadlines for payment, you're establishing expectations and encouraging promptness.

Think of it as a game of financial tag, but with a ticking time bomb strapped to your ankle. The sooner you pay, the sooner you're free – and the sooner you can get back to playing without the threat of an explosion.

Efficiently Tracking and Monitoring Accounts Receivable

Keeping tabs on your accounts receivable is crucial for maintaining a healthy cash flow. It's like tending to a garden – regular watering and fertilizer prevent any wilting or withering.

So, make use of accounting software, create reports, and stay on top of your customers' payment patterns. After all, we're not just talking about numbers on a screen; we're talking about your financial well-being.

Ensuring Accurate Accounting for AR

Accounting might not be everyone's cup of tea, but when it comes to accounts receivable, accuracy is key. Properly recording and documenting transactions ensures that your financial statements stay in tip-top shape – clear, organized, and ready to impress.

So, double-check those entries, reconcile your accounts, and embrace your inner financial superhero. With great accuracy comes great responsibility.

Embracing Automation for Accounts Receivable Management

Are you tired of manually sending invoices, making constant phone calls, and chasing after late payments? Well, fear not! Automation is here to save the day – or at least lighten your workload.

By embracing automation for accounts receivable management, you can wave goodbye to time-consuming tasks and say hello to streamlined processes. It's like having a robotic assistant who never complains and always gets the job done – except without all the beeping and whirring.

Handling Special Situations in Accounts Receivable

While most accounts receivable transactions go as smooth as butter, there are times when things get a little more complicated. Prepare yourself for the bumpy road ahead as we discuss how to handle these special situations.

The Journal Entry for Accounts Receivable Made Simple

If you're still awake, congratulations! Now it's time to delve into the exciting world of journal entries for accounts receivable. But fear not, we'll keep it simple and jargon-free, like explaining the rules of frisbee golf to your grandma.

We'll discuss terms like debits, credits, and the magical balancing act of double-entry bookkeeping. By the end of this section, you'll be journal entry-savvy – ready to tackle the financial world one entry at a time.

Understanding the Difference: Accounts Receivable vs. Accounts Payable

Accounts receivable and accounts payable – two sides of the same financial coin, yet with distinct differences. It's like comparing a cat to a dog – both adorable in their own way, but with different financial responsibilities.

In this section, we'll unravel the contrasting nature of accounts receivable and accounts payable, exploring how they influence cash flow, customer relationships, and your overall financial well-being.

Key Takeaways for Effective Accounts Receivable Management

Now that we've traveled through the exciting world of accounts receivable, it's time to wrap things up with some key takeaways. These nuggets of wisdom will guide you on your path to becoming an accounts receivable master.

- Communicate clearly and establish expectations.

- Stay organized and monitor accounts receivable.

- Automate where possible to streamline processes.

- Handle special situations with confidence and flexibility.

- Understand the difference between accounts receivable and accounts payable.

Remember, Rome wasn't built in a day – and neither is a perfectly managed accounts receivable process. But with these key takeaways in mind, you'll be well on your way to achieving financial harmony.

Additional Accounting Resources for Small Businesses

If you've made it this far and hunger for more accounting knowledge, we've got you covered. Below, you'll find a list of additional resources to satisfy your thirst for financial wisdom:

- Books: Dive into the world of accounting literature, where authors pour their financial expertise into pages waiting to be devoured.

- Online Courses: Unleash your inner number cruncher by enrolling in online courses that transform accounting concepts into digestible bits of knowledge.

- Webinars and Seminars: Join the accounting community as experts share their wisdom through online webinars and in-person seminars.

- Professional Organizations: Connect with fellow accountants and stay up to date with the latest news in the accounting world by joining professional organizations.

- Mentors: Seek guidance from experienced accountants who can impart their wisdom and help you navigate the financial maze.

So, whether you prefer burying your nose in books or engaging with the accounting community, these resources will equip you with the tools needed to conquer the accounting landscape.

And there you have it – a comprehensive guide to understanding the basics of the accounts receivable process. We've explored the accounts receivable cycle, streamlined the process in 5 steps, delved into special situations, and even squeezed in a journal entry tutorial. Remember, mastering accounts receivable takes time and practice, but with a touch of automation and a sprinkle of financial savvy, you'll be well on your way to achieving accounts receivable greatness.

I'm Simon, your not-so-typical finance guy with a knack for numbers and a love for a good spreadsheet. Being in the finance world for over two decades, I've seen it all - from the highs of bull markets to the 'oh no!' moments of financial crashes. But here's the twist: I believe finance should be fun (yes, you read that right, fun!).

As a dad, I've mastered the art of explaining complex things, like why the sky is blue or why budgeting is cool, in ways that even a five-year-old would get (or at least pretend to). I bring this same approach to THINK, where I break down financial jargon into something you can actually enjoy reading - and maybe even laugh at!

So, whether you're trying to navigate the world of investments or just figure out how to make an Excel budget that doesn’t make you snooze, I’m here to guide you with practical advice, sprinkled with dad jokes and a healthy dose of real-world experience. Let's make finance fun together!